1. The possibility of claiming tax losses retrospectively

The Ministry of Finance has prepared the first proposal of an Amendment to the Income Tax Act, which is to ground the possibility of claiming tax losses for individuals and corporations retrospectively for the two years preceding 2020. Let us therefore examine, in a question and answer form, the basic regulations contained in the proposal.

- We are a limited liability company, we use the calendar year as the accounting period and expect that we will have a tax loss for 2020. How will we be able to claim it?

In the proposal for the Amendment of the Income Tax Act, the Ministry of Finance expects the calculation of tax losses retrospectively for the expired period with the aid of additional tax returns for the expired tax period. We show the possibilities in examples:

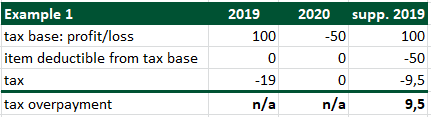

Example 1:

The corporation has accounted for a tax base of CZK 100M for the 2019 tax period and was assessed tax amounting to CZK 19M (19% tax rate) which it paid duly and on time. In the 2020 tax period the corporation accounted for a tax loss amounting to CZK 50M. The corporation has decided to utilize the possibility of claiming the loss retrospectively, and with an supplementary tax return for the 2019 tax period claims an item deductible from the tax base amounting to CZK 50M. For 2019, therefore, the tax will be fixed at the amount of CZK 9.5M, and in the amount by which the tax has been reduced compared to the last known tax for the 2019 tax period, a refundable overpayment amounting to CZK 9.5M will arise for the entity. Therefore, within 30 days of filing both tax returns (the regular one for the 2020 calendar year and the additional one for 2019), it will be reimbursed by the tax administration.

Recapitulation of the example in CZK million:

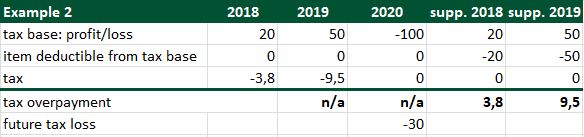

Example 2:

The crporation accounted for a tax base in 2018 amounting to CZK 20M, and CZK 50M for 2019, and the corresponding tax was assessed. For 2020, a loss amounting to CZK 100M will be assessed for the corrporation. Because the loss for 2020 exceeds both tax bases for 2018 and 2019, the claim will then be divided into a “back” part (maximum 70) and a “forward” part (the remaining 30).

The corporation will thus select the maximum possible option of recourse back and will file an supplementary tax return for 2018 and 2019 in which it will deduct from the tax base the assessed tax loss, both for 2018 at the amount of CZK 20M and for 2019 at the amount of CZK 50M. The refundable tax overpayment will thus be equal to the amount of the full tax paid for 2018 and 2019.

Then, in the tax return for 2021 and in the four subsequent tax periods it can claim the remaining part of the 2020 tax loss at the amount of CZK 30M.

Recapitulation of the example in CZK million:

- If we thus use the possibility to claim tax loss retrospectively, when will we be refunded by the government?

The proposal expects that, along with the regular tax return for 2020, you will also file the supplementary tax return to claim a loss for 2019 and 2018, as the case may be. The moment when the money is refunded thus depends on the term for filing the tax return for 2020 and the simultaneous filing of the additional tax return for 2019 (and 2018, as the case may be). If you are not an audited accounting entity and you do not use the services of a tax advisor, your term for filing the tax return is 1st April 2021. If you have a mandatory audit or your tax return is processed by a tax advisor, your term is postponed to 1st July 2021. You will thus receive the overpayment after filing the tax return and the request for overpayment refund.

- Will it be possible for individual entrepreneurs or individuals to claim tax losses?

Yes, the Income Tax Act Amendment provides the possibility to claim tax losses incurred by individuals who have incomes from entrepreneurial activity (Section 7) or from rental (Section 9). They will be able to reduce their tax bases in 2018 or 2019 by the tax loss incurred in 2020. More precisely, therefore, the individual income tax payer can deduct the tax loss from the tax base only up to the amount of the sum of partial tax bases, pursuant to Sections 7 to 10.

In the answers we used the Income Tax Act Amendment proposal, which was sent to professional chambers for comments. It is possible that the resultant passing of the Amendment to the Act will nonetheless differ in certain details.

2. In the financial statement compiled for the accounting period ending on 31.12. 2019, how should one react to the current situation?

The complicated current situation connected with COVID-19 and the measures passed to limit its spread have to various extents impacted all accounting entities which have compiled or are compiling a financial statement for the finished calendar year 2019.

The current state can be compared to a situation when a company shows excellent results for the past period, but a large fire breaks out in a manufacturing building before the financial statement has been compiled. Accounting regulations refer to this situation as an non-adjusting event, which is an event that reflects conditions that arose after the end of reporting period. Such an event does not change the data shown in the balance sheet and profit and loss statement, but it has to be described in the notes to the financial statements. The financial statement reader has to receive information that a significantly negative event took place which will influence the future activity of the accounting entity.

We believe that the COVID-19 outbreak is comparable to the example above, since the economic situation has changed significantly.. We are of the impression that in most cases, this is a situation where no value adjustment of the in the financial statement would occur (e.g. no creation of reserves or provisions), under the assumption that the going concern principle of the accounting entity has not been contravened. However, respective description in the notes might be appropriate in most of the cases.

The procedure recommended for accounting entities, by the Chamber of Auditors of the Czech Republic

- The accounting entity management, in cooperation with other persons entrusted with administration and management, have to assess whether the going concern principle of the accounting entity has not been cast into doubt, i.e. whether the accounting entity is able to continue its activities in the near future. It should state the result of its assessment in the notes to the financial statement, where it should expressly be stated whether the company expects to continue its activities at least 12 months after the date of the financial statement (going concern principle) and whether the financial statements have been compiled on the basis of this going concern principle.

- The statement should be based on an analysis by the management, which takes into account all important influences, e.g.

- a drop in asset values due to an adverse global economic situation,

- disruption of supplier and customer relationships or other disruptions of entrepreneurial activities,

- disruption of present or future monetary flows with an impact on the liquidity and financial situation of the accounting entity,

- termination or inaccessibility of credits or changes in credit conditions etc.

The assessment result has to be as follows:

a) The accounting entity’s ability as a going concern is not under threat.

For instance, the following declaration might be appropriate for the notes:

The management of the Company has considered the potential impacts of COVID-19 on its activities and has come to the conclusion that they do not have a significant influence on the expectation of the going concern basis of the business. In view of this fact, the financial statements as at 31 December 2019 have been processed under the expectation that the Company will further be able to continue its activities.

b) The management expects the accounting entity’s ability to continue as a going concern, although there is significant uncertainty.

If the accounting unit management assesses that it expects ability to continue as a going concern but there is at the same time a significant uncertainty that the accounting entity will be able to continue in its activities (e.g. the future functioning of the accounting entity is dependent on state subventions, the duration of the crisis, future agreement with the bank, the ability of customers to pay their liabilities), the accounting entity management is obliged to explain and describe this uncertainty and connected facts in the notes to the financial statement. This fact, however, does not influence the valuation of assets and liabilities of the accounting entity as at 31 December 2019.

c) The management conclude that the going concern basis has not been fulfilled.

Should the accounting entity management conclude that, as a result of the impact of the current event and conditions on the accounting entity, the going concern basis does not apply, it also has to modify the values of assets and liabilities in the financial statements and comment its situation in a supplement to the financial statement.

The situation of the company in connection with the coronavirus epidemic should likewise be described in the company’s annual report.

The entire text of the recommendation by the Chamber of Auditors can be found at the address: https://www.kacr.cz/covid-191

When compiling the financial statement, we are ready to consult the above-mentioned procedures with you individually.